Patrick Iturra, Asset/Investment Manager & Consulting May 1, 2023

First Republic Bank Seized and Sold to JPMorgan Chase & Co.

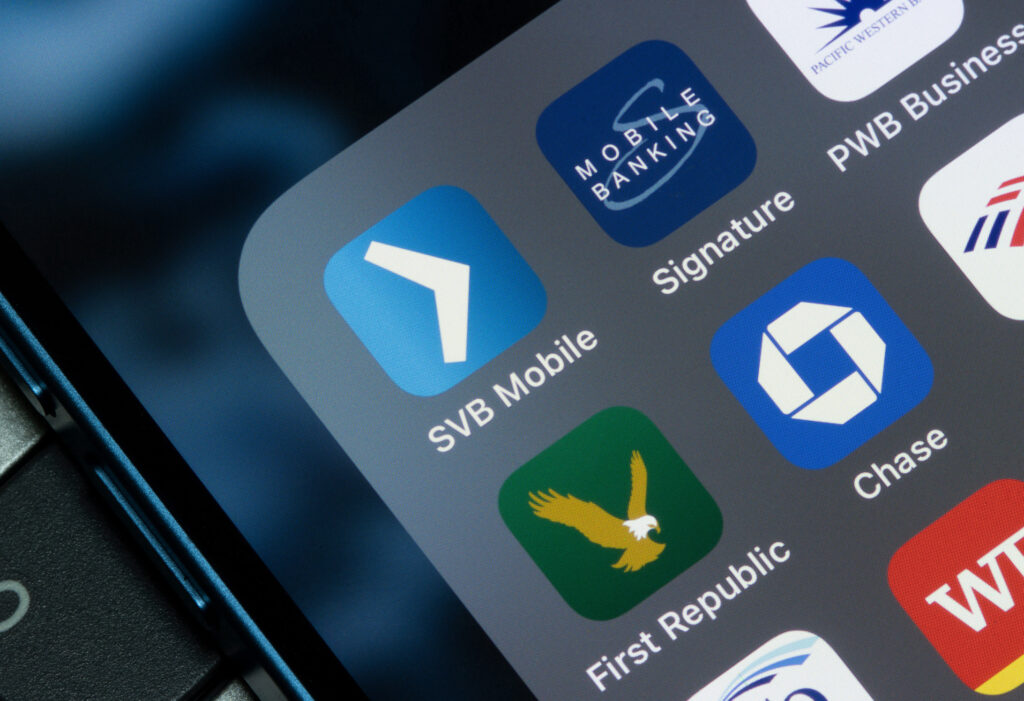

In a significant event in the banking industry, JPMorgan Chase & Co. acquired the failing First Republic Bank following the second-largest bank failure in U.S. history. This acquisition highlights the ongoing challenges faced by the banking industry since the 2008 financial crisis, as JPMorgan Chase & Co. takes over all of First Republic Bank’s $92 billion in deposits—both insured and uninsured—and purchases most of the bank’s assets, including $173 billion in loans and $30 billion in securities. Let’s take a closer look at JPMorgan Chase & Co.’s acquisition of First Republic Bank and its implications for the banking industry.

NPR News Live

JPMorgan Chase & Co. Assumes First Republic Bank’s Deposits and Acquires Most of Its Assets

The sale of First Republic Bank to JPMorgan Chase & Co. represents an effort to prevent the bank’s collapse from causing broader financial instability. By assuming all of the bank’s deposits, both insured and uninsured, JPMorgan Chase & Co. will be able to provide continuity to the bank’s customers and ensure that they have access to the financial services they need.

Learn what JPMorgan is doing in Alternative Investments: JP Morgan Open First Virtual bank in Metaverse: Aims at $1 Trillion

In addition to assuming the bank’s deposits, JPMorgan Chase & Co. is also acquiring most of the bank’s assets, including $173 billion in loans and $30 billion in securities. This will give JPMorgan Chase & Co. a significant presence in the California market, where First Republic Bank was based, and allow the bank to expand its regional offerings.

The Significance of First Republic Bank’s Failure: A Reminder of Ongoing Challenges in the Banking Industry

The seizure of First Republic Bank and its subsequent sale to JPMorgan Chase & Co. highlights the ongoing challenges faced by the banking industry in the wake of the 2008 financial crisis. While many banks have adapted to changing market conditions and regulatory requirements, others have struggled to keep pace, leading to failures and seizures.

In the years since the financial crisis, regulators have worked to strengthen the banking industry and prevent repeated events that led to the problem. While progress has been made, events like the seizure of First Republic Bank serve as a reminder of the ongoing challenges faced by the industry and the importance of continued vigilance and reform.

Overall, the seizure and sale of First Republic Bank represent a significant event in the history of the banking industry. While the bank’s failure was a blow to its customers and employees, the sale to JPMorgan Chase & Co. will ensure continuity and stability in the financial sector, preventing broader instability and chaos. (NPR News)

Learn More: The banking crisis, new opportunities

Business development is the ideas, initiatives, and activities that help improve a business. My experience results in your business’s increased revenue, expansion, and profitability by building strategic partnerships and making strategic business decisions.

“I don’t sell houses. I grow your Assets” –Patrick Iturra, Asset/Alternative Investment & Management.