Patrick Iturra Report

Patrick Iturra Report

There is a global trend of investing in cryptocurrencies to make short/long-term capital gains, and people are becoming aware of crypto and investing their hard-earned money.

As per the latest report given by Statista for the most prominent cryptocurrencies, there are multiple options such as BitCoin, Ethereum, Canada, Binance, Tether, etc. Out of all these, Bitcoin has emerged as the top cryptocurrency with a market capitalization of $856 billion.

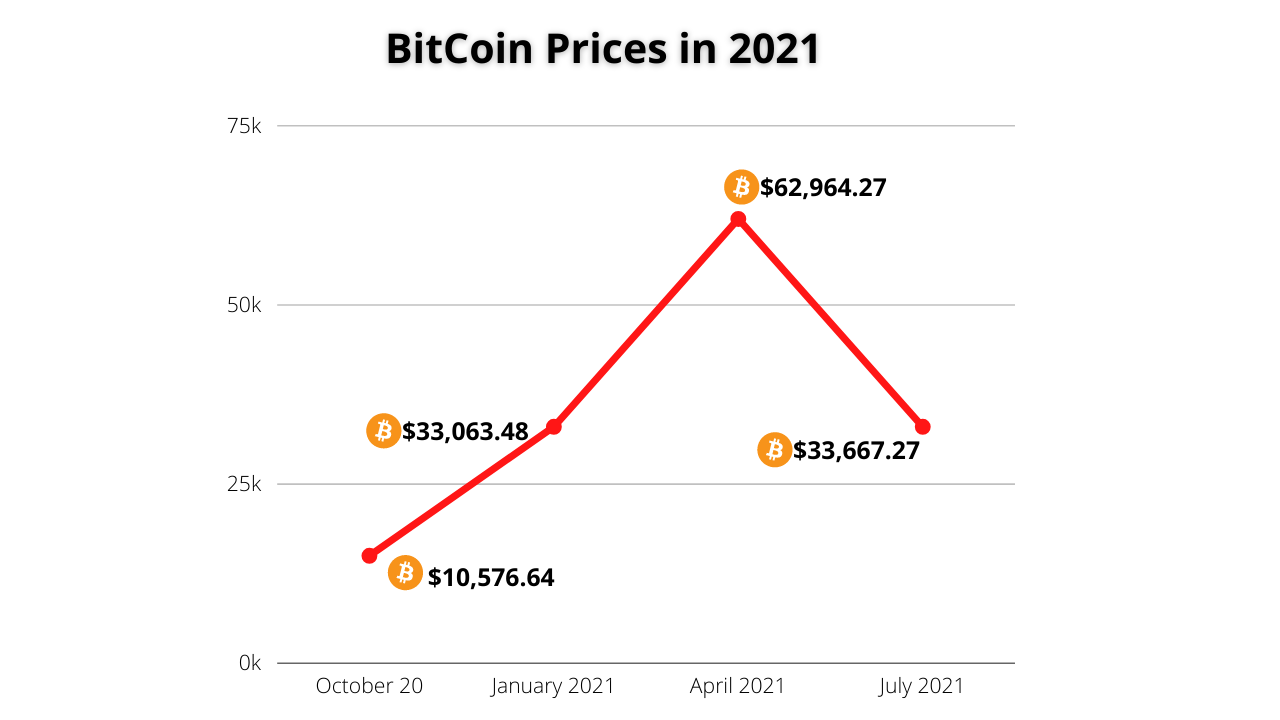

The current rate of bitcoin is around $48,000, which is way lower than its all-time high of $62,964.27. Since then, its valuation has been going up and down, where bitcoin has touched its lowest at $29,797.

This fluctuation with the decrease in prices has piled up significant losses to people, especially, who invested in BitCoin at 65,000 or even 50,000. Recently there was a case where a man lost all his life savings in cryptocurrency hype.

I have used the word “hype” because most people didn’t plan or think about their investments and return via bitcoin. Most of them felt that bitcoin was some goldmine or a lottery that could make them rich overnight.

In reality, the truth is exact, and just like any other means of investment, you have to plan everything before putting your money on the charts. The downfall of bitcoin has also inflicted fear among people to stop investing in the currency.

Well! As a proficient strategic financial advisor, I have been helping people in building/multiplying their wealth over the past 20 years. I am creating this blog to educate my audience about strategies to build long-term cash flow using Bitcoin.

To create long-term cash flow, I want you to go back to basics. You need to invest & create real estate(Assets) for steady cash flow and pay fewer taxes over time.

Real estate never disappoints, and it is one of the best ways to build wealth and reduce your tax liability at the same time. There is a wide variety of benefits of real estate investing. The homeowners also benefit from the personal-residence exemption, which saves your profit from the capital gains tax and deductions in the mortgage interest. Here are some of the strategies that you can use to create long term cash flow and avail deductions at the same time:

1.) Use depreciation deduction to recover the cost of your income-generating rental property. The IRS allows you to take deductions against reasonable wear & tear, deterioration, etc. One of the most common depreciation methods is the MACRS(Modified Accelerated Cost Recovery System), where rental (residential) properties are depreciated over 27.5 years. In contrast, all the appliances used are depreciated over 15 years.

2.) Use the 1031 Exchange that allows you to sell one investment property and invest the procured capital into another property of equal or higher value. But, there is a condition where you have to deliver a written list of qualified/replacement property within 45 days. Also, you must purchase the qualifying property within 180 days or 180 days after his tax return date. Keep in mind that there are a lot of other regulations & taxation codes involved in the process. Therefore, you should consult with an experienced real estate consultant to go through the process smoothly.

3.) Investors can raise capital against their real estate property. When you have built a sizable real estate(whether personal home or rental property), then you can refinance your property. Refinancing can generate extra capital for -your further investments. Considering the capital, you can get an amount up to 80-85% of your property’s value. For example, if you have a property of $100,000 with a $60,000 loan, then you can get $80,000 as the refinanced amount. But, there are also other metrics involved like your credit score, debt-to-equity ratio, and debt-to-income ratio.

Important Note: Refinancing is a riskier approach, and you must consult with an experienced real estate consultant.

4. Defer taxes for your home sales

The capital gains from a taxpayer’s primary residence sale are exempted from taxation with a limit of $250,000 to $500,000 for single individuals and married couples, respectively. Hence you can plan before selling your home and invest further utilizing the 1031 exchange. It is a strategy to be used by individuals with appreciating properties to build wealth with minimal tax.

5. Deduct Mortgage Interests

Investors/borrowers are subjected to pay a portion of mortgage interest on their tax returns. Initially, the mortgage payments are higher in the early years and decrease with time as the mortgage is paid off.

How to buy real estate with bitcoin? Invest via Cryptocurrencies?

Yes, you can buy real estate with bitcoin, where both the buyer and seller have to agree on the terms with cryptocurrency. All you have to do is find insurance and an escrow company handling the transfer rather than traditional money.

If you have doubts, I will mention the top 3 reasons to use your bitcoins and Invest in real estate.

(Alt text: Top 3 Reasons to Invest Your Bitcoins in Real Estate in 2021 – Patrickiturra.com)

Top 3 Reasons to Invest your Bitcoins in Real Estate

1. Investing in a secure asset

Bitcoin is highly volatile, where the valuation goes up and down frequently. Using the same bitcoin to purchase real estate is a safer option, and it appreciates and is capable of generating regular cash flow. Even though crypto might generate outstanding returns, real estate is a safer option with less volatility.

2. Chances of getting a better deal

Sellers interested in bitcoin might offer you a discount, or you can further negotiate with them. The main point here is that the seller can sell bitcoin for a better value and generate higher returns. It is subjective from the seller to the seller! But if he’s interested, then you can get a discount on the property.

3.No need for Mortgage

Buying real estate with cryptocurrency is faster and easier to purchase real estate by eliminating the whole mortgage process. Hence, if you can buy real estate with sufficient cryptocurrency with cash makes your offer stronger.

The best time to invest in Real Estate is right now!

Investing in real estate requires a lot of research to identify and find suitable properties that create long-term cash flow with minimal tax obligations. It is a proven way to build wealth and beat inflation. I hope the purpose of this blog is to help you to invest in cryptocurrency and make sure that you have the suitable investment for a better, secure financial future.

In case you have any inquiries, you can contact me – Patrick Iturra. I am always ready to help you out and make sure that your hard-earned money gets appropriately channeled.

Patrick Iturra Report Estate Investments Group